There is an 89.65% chance that you won’t need any of this advice until much later in life. One of youth’s benefits for most Americans is good health and an optimistic outlook on the future. According to a World Health Organization study in 2013, the probability of premature death for Americans aged between 15 to 60 years is 10.35% (13.0% for men and 7.7% for females). That means that 89.65% of Americans that reach age 15 will live to be at least 60 years old.

any of this advice until much later in life. One of youth’s benefits for most Americans is good health and an optimistic outlook on the future. According to a World Health Organization study in 2013, the probability of premature death for Americans aged between 15 to 60 years is 10.35% (13.0% for men and 7.7% for females). That means that 89.65% of Americans that reach age 15 will live to be at least 60 years old.

To illustrate a thought-provoking quote from a famous historical figure:

Joseph Stalin referencing Kurt Tucholsky

- “The death of one man is a tragedy; the death of millions is a statistic.”

It’s rare to reach adulthood without experiencing death. Whether you experience the loss of a grandparent, family member, or a friend, it hurts. And even though the person whom you knew passed away, they are considered a statistic. Statistics eliminate the personal elements of the person whom breathed, laughed, loved, and lived. They are merely data in the big picture.

The reason why you’ll never consider the departed person a statistic is because you related to them at some point. You felt loss when Robin Williams passed away because you saw him and understood his presence on the Earth. But you never saw the person who died of similar circumstances where they easily fall into the statistic category of Americans that pass away via suicide.

Now, it’s important to live your life with delight and to prepare for a happy future. Yet, it is crucial to prepare for the unfortunate probability that you might fall into the 10.35% of Americans whom never reach age 60.

Now, it’s important to live your life with delight and to prepare for a happy future. Yet, it is crucial to prepare for the unfortunate probability that you might fall into the 10.35% of Americans whom never reach age 60.

To help you prepare your own legacy, here are some estate planning terms that every young adult should grasp as well as some tips on how to prepare.

It makes everyone sad and uncomfortable to address this morbid topic, yet, you’ll realize that being logical and responsible can help the people whom will never see you as a statistic.

Probate

The legal process in which the American state, where the deceased resided, distributes property in accordance to the person’s wishes expressed via their will. If the person dies without a will, their spouse, children, or next of kin (typically parents or siblings) will receive the property after the probate process is complete. Probate takes time and there are tremendous legal and tax complexities so it is advisable to discuss your wishes with an estate planning attorney or a financial professional.

Last Will and Testament

Write a will! With this legal document, you can name the person executing your will, the people to take care of your children and pets, and you can designate specific items to people whom you desire. For example: your hockey card collection to your favorite nephew or a certain amount of money to be donated to your favorite non-profit.

- For a simple software at a reasonable price, please visit http://www.nolo.com/ or if your plans are complicated, you can interview local estate planning attorneys who charge a flat fee to craft these necessary documents

Personal Letter of Instruction

Ignore the legal jargon and write out your own wishes. Which song do you want at your memorial? Do you want to be buried or cremated? How do you want your digital accounts like Facebook, LinkedIn, and Twitter handled? In your Personal Letter of Instruction, you can express your desires. Digital assets currently confuse the legal system on how to handle these accounts but if you express your wishes in your Personal Letter of Instruction, it allows them to try their best to accommodate your wishes.

Beneficiary (ies)

Who gets your stuff? In the complicated legal world, property gets transferred by law, trust, or contract. It’s important to understand which types of property get distributed how. You can’t just write in your will, “everything goes to my pet goldfish,” because certain property  might be designated to go elsewhere which would trump your will’s intentions.

might be designated to go elsewhere which would trump your will’s intentions.

When you established a retirement account, you were instructed to list a beneficiary. These accounts include Life Insurance Policies, your company sponsored retirement account (think 401(k)s), IRAs, and a few others. No matter what you write in your will, the person listed as your beneficiary on these accounts will pass by contract. If you need to update, contact the appropriate party to help you. For 401(k)s: contact your Human Resources department.

Underutilized strategies include your personal checking and savings accounts at the bank. You can easily set up a Payable on Death (POD) or Transfer on Death (TOD) designation which instruct the institution to transfer the account to your person of choice. These contracts act much quicker than the probate process.

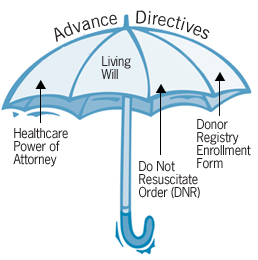

Advanced Directives and Living Wills

Accidents happen, but they don’t happen as often as news organizations make them appear. In a study done in the Netherlands, a person under 40 dies suddenly 0.00207% (0.00286% for men and 0.00124% for women). That means that most people whom pass away don’t go in one accident. Most people pass away through prolonged sickness, disease, or injury. Just think of Breaking Bad’s Walter White.

Unlike Walter White, don’t become a meth dealer. For young adults, these two topics are worth addressing.

- Springing Durable Power of Attorney for Health and/or Financial

These documents allow you to designate a trusted person with good judgment to handle your medical or financial decisions while you’re unable. Once a doctor declares you unable to make decisions for yourself, these documents “spring” into action.

When assigning someone to handle these responsibilities, make sure the person is comfortable being assigned your decision-maker. In regards to health, the person needs to be your advocate if there are disagreements about your medical care, and in regards to financial, the person needs to be savvy and honest.

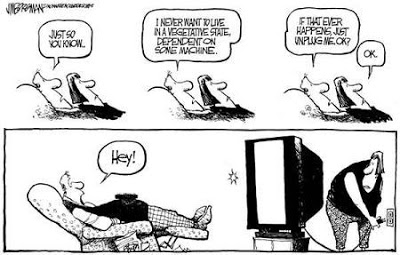

- Living Will

Every few years, the News showcases a situation where someone on life support causes controversy. Part of the family wants the person to live while another part wants to pull the plug. The person’s voice who’s missing is the person on life support. By filling out a living will, you can order the physician how you want your situation handled in case you’re ever on life support.

Responsible Legacy Planning

Everyone’s situation is different and there is no way to handle every important legacy planning subject into a single blog post. Get educated about legacy planning by talking to trusted professionals and doing your own research.

To influence you to take some action,  address these top items as soon as possible:

address these top items as soon as possible:

- Write a Will

- Fill out Advanced Directives and Powers of Attorney

- Update Personal Accounts with POD and TOD beneficiaries

In Remembrance

This post is dedicated to William Otto Marle.

My fiancée’s grandfather never quit learning and loving his family up to his last moments.

It was a pleasure to get to know him in his final years and he will be missed.

Great stuff Dan!

>

LikeLike

Thanks Dave for reading and for the nice comment. I’m glad you enjoyed the article. Happy New Year!

LikeLike